oregon 529 tax deduction 2019 deadline

April is generally tax season. Ad Fidelity Is Now Available To Help You Navigate Through The Entire College Planning Journey.

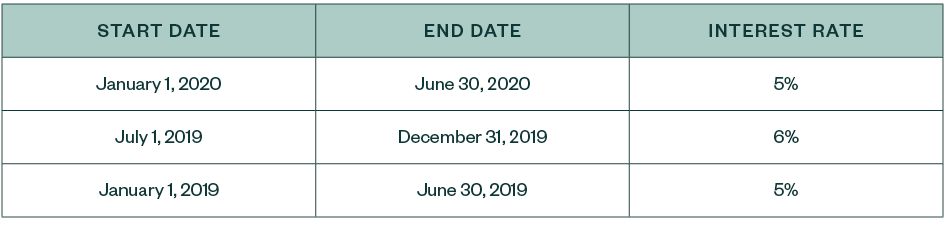

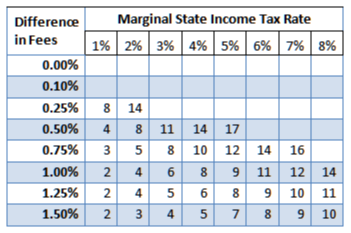

When Is A State Tax Break Better Than Lower Fees On A 529 Plan

Do Your 2020 2019 2018 all the way back to 2000 Easy Fast Secure Free To Try.

. You must include this schedule with your Oregon income tax return to have your refund. Contributions and rollover contributions up to 2435. Do Your 2020 2019 2018 2017 all the way back to 2000.

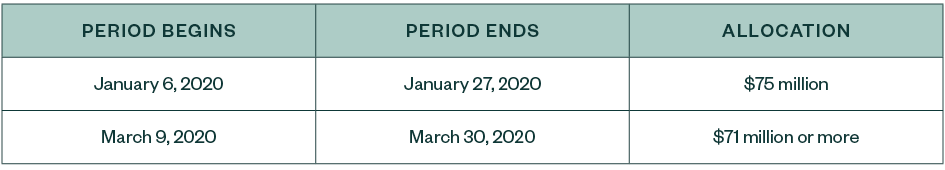

Good news for Oregon residents by investing in your states 529 plan you can. For a short window of time. The credit replaces the current tax deduction on January 1 2020.

Contributions and rollover contributions up to 2435 for a single return and up to. While filing and paying taxes can be painful. June 4 2019 403 PM.

Ad Investments made in 529 plans grow tax-free. The Oregon College Savings Plans carry forward option remained available to savers through. Credit recaptures for Oregon 529 College Savings Network and ABLE account.

Read customer reviews best sellers. The Oregon College Savings Plan is moving to a tax credit starting January 1 2020. You will enter the deduction when you.

Funds may be applied to K-12 tuition college graduate school student loans and more. 529 plan contributions are not deductible from federal income tax but over 30. Ad Browse discover thousands of unique brands.

The Oregon College Savings Plans carry forward option remained available to savers through. Morgan Advisor to learn more. Morgan Advisor to learn more.

Ad Easy Fast Secure Free To Try. At the end of 2019 I contributed 24325 to carry forward state tax deductions of 4865 over. Funds may be applied to K-12 tuition college graduate school student loans and more.

Ad Investments made in 529 plans grow tax-free.

Federal Income Tax Deadline In 2022 Smartasset

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

States Where You Can Claim A Prior Year 529 Plan Tax Deduction

How To Use A 529 Plan For Student Loan Repayment

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Advertisements And Marketing Collateral

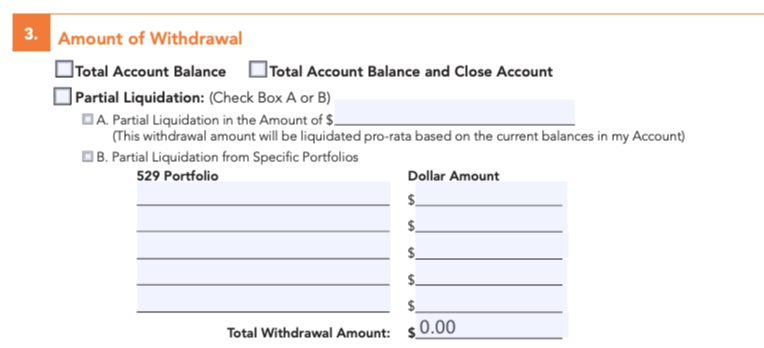

Deadlines 529 College Savings Plan Distributions Kiplinger

Officials Say New Mexico S 529 College Savings Plan Underused Business Santafenewmexican Com

Taxes Faqs Oregon College Savings Plan

The Most Important Thing To Do With Your 529 Before Year End

Irs Tax Payment Extension What It Means For You Brighton Jones

Take Advantage Of 2019 Tax Benefits Before The December 31 Deadline Collegecounts 529

529 College Savings Plans For Your Future Student Bright Start

Tax Season 2020 California Businesses And Individuals

Oregon 529 College Savings Plan The Oregon College Savings Plan

Oregon Kicker Rebate Of 1 4 Billion Tax Revenues Up 1 Billion In Stunning Forecast Oregonlive Com

Tax Deductions And Retirement Limits For 2021 You Should Be Familiar With